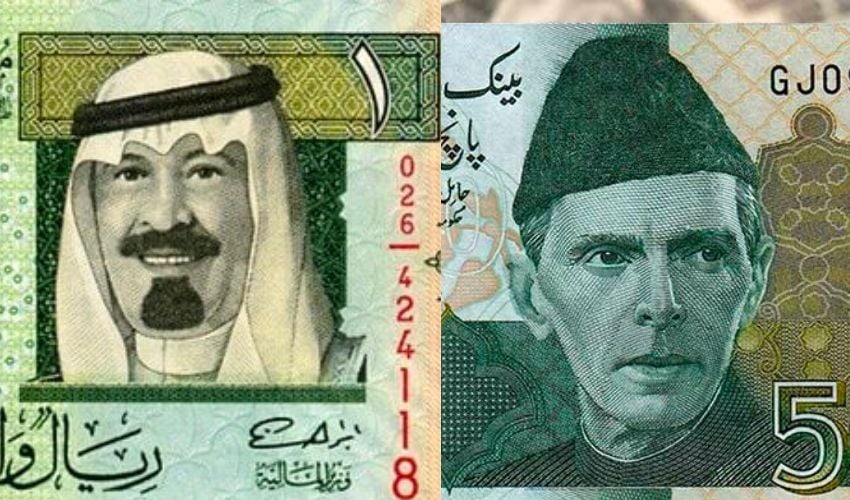

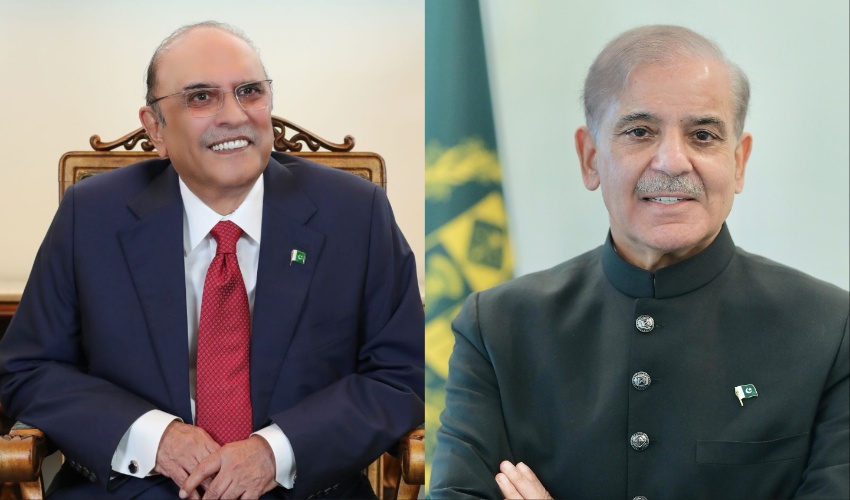

Negotiations between Pakistan and the International Monetary Fund (IMF) have intensified as the IMF has called for significant changes in the country's tax regime.

Sources reveal that the IMF has demanded an end to tax exemptions, incentives, and privileges, with a focus on increasing taxes on privileged sectors.

Among the proposals put forward by the IMF are increases in taxes on luxury plots and cars, as well as imposing taxes on the property sector. Specifically, the IMF suggests imposing higher taxes on plots valued at over Rs50 million and abolishing tax exemptions on capital gains from the sale of residential property.

Also Read: KP govt set to impose new tax on tobacco

Furthermore, the Federal Investigation Agency (FIA) has proposed changes in tax slabs for the salaried class, with the IMF supporting a hike in taxes on income ranging from Rs300,000 to Rs500,000. Additionally, the IMF has also called for tax increases on luxury car imports and suggested raising the withholding tax on new vehicle purchases.

These proposals indicate the IMF's push for comprehensive tax reforms in Pakistan, aiming to enhance revenue generation and address fiscal challenges. The discussions between Pakistan and the IMF are ongoing, with stakeholders evaluating the potential impact of implementing these tax measures on the country's economy and citizens.

Also Read: Pakistan-IMF talks Day 2: Fund told about priorities of economic reform agenda

Earlier on Tuesday, Pakistan informed the IMF about the priorities of its economic reform agenda. Among the key priorities discussed are the increase in the tax-to-GDP ratio and reforms in the tax machinery to enhance revenue generation.

Additionally, part of the agenda includes the reform or privatization of government-owned enterprises that burden the national exchequer. The registration of traders, along with efforts to document and digitize the economy, is also high on the agenda.

Also Read: After introductory meeting, IMF stresses political stability for economic stability

Reforms to ensure the financial stability of the energy sector in the future have been emphasized. The Ministry of Finance is optimistic about the impact of these reforms, projecting that GDP growth will exceed 5% within two years.

Moreover, Finance Ministry sources anticipate a reduction in inflation to single digits of 5% to 7% by the end of the next financial year. The IMF has also been assured of expanding the social safety net.