Live Updates: Rs18.9 trillion Federal Budget 2024-25 to be presented today

Federal Board of Revenue (FBR) has set an ambitious tax collection target of Rs12,970 billion

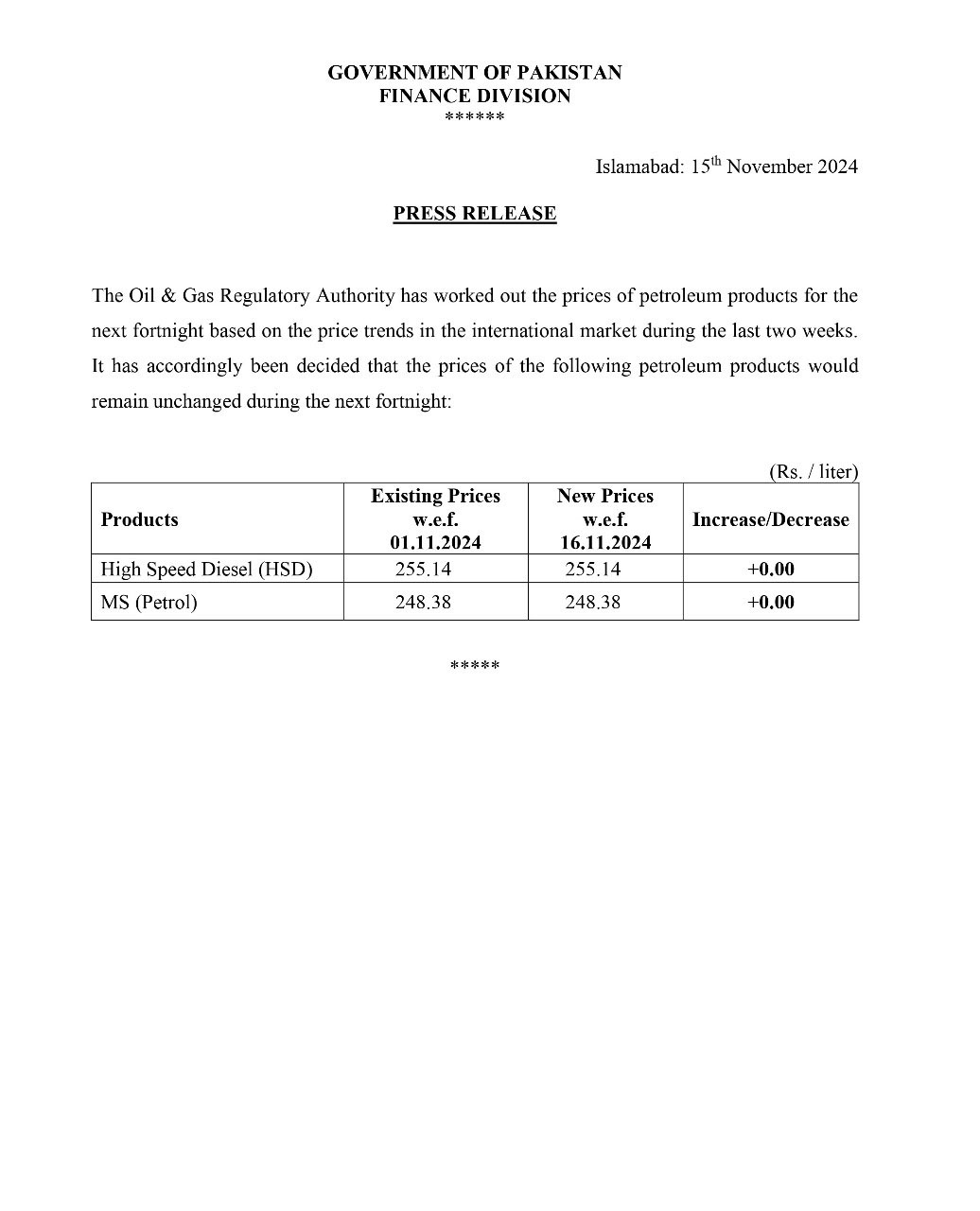

Petrol, diesel prices remain unchanged for next fortnight

Prime Minister Shehbaz Sharif-led government has decided to keep the petrol and diesel prices unchanged for the next fortnight starting from November 16, 2024.

According to a notification issued by the finance ministry, the petrol price has remained stable at Rs248.38 per litre, while the new price of high-speed diesel has remained unchanged at Rs255.14 per litre.

The price of kerosene oil has remained stable at Rs161.54 per litre.

Meanwhile, the price of light diesel has remained unchanged at Rs147.51.

On October 31, the petrol price had increased by Rs1.35 per litre to reach Rs248.38 per litre, while the price of high-speed diesel had increased by Rs3.85 per litre to reach Rs255.14.

Govt jacks up petrol by Rs1.35, high-speed diesel by Rs3.85 per litre

Prime Minister Shehbaz Sharif-led government on Thursday announced new petrol and diesel prices for the next fortnight.

According to a notification issued by the finance ministry, the prices of petroleum products for the next fortnight, starting from 1st November 2024.

With the adjustment, the petrol price has increased by Rs1.35 per litre to reach Rs248.38 per litre, while the new price of high-speed diesel has increased by Rs3.85 per litre to reach Rs255.14.

The price of light diesel has now reached Rs147.51 after witnessing a drop by Rs2.61.

On October 15, the Pakistan government announced that the price of petrol would remain unchanged, while the price of high-speed diesel (HSD) was raised by Rs5 per litre for the next fortnight.

Govt keeps petrol price unchanged, hikes HSD by Rs5

Prime Minister Shehbaz Sharif-led government on Tuesday announced that the price of petrol would remain unchanged, while the price of high-speed diesel (HSD) was raised by Rs5 per litre for the next fortnight.

According to a notification issued by the finance ministry, "The Oil & Gas Regulatory Authority (OGRA) has worked out the consumer prices of petroleum products, based on the price variations in the international market."

It added the prices of petroleum products for the next fortnight, starting from 16th October 2024.

With the adjustment, the petrol price now stands at Rs247.03 per litre, while the new cost of high-speed diesel is Rs251.29 per litre.

It is noteworthy that just a few weeks prior, on September 30, the government had announced a reduction in fuel prices. Petrol was decreased by Rs2.7, high-speed diesel by Rs3.40, and light-speed diesel by R1.3per litre.

Govt announces reduction in petrol, diesel prices from Oct 1

A sigh of relief for inflation-stricken masses as Prime Minister Shehbaz Sharif-led government on Monday announced a massive reduction in petrol and diesel prices from October 1 for the next fortnight.

According to a notification issued by the Finance Ministry, the price of petrol has been reduced by Rs2.7 per litre, while high-speed diesel (HSD) has seen a reduction of Rs3.40 per litre.

With the adjustment, the price of petrol now stands at Rs247.03 per litre, while the new price of high-speed diesel is set at Rs246.29 per litre.

The government also announced a reduction in kerosene oil prices by Rs3.57 per litre, bringing the new rate to Rs154.90 per litre.

The reductions will be effective for the next fortnight, providing temporary relief to consumers as global fuel prices fluctuate.

Latest: Petrol price in Pakistan may drop again from Oct 1

Petrol and diesel prices in Pakistan are expected to see a reduction starting October 1, 2024, as the government considers passing on relief to consumers following a significant decline in global oil rates.

Sources privy to the matter said with the matter revealed that while discussions are underway, the exact figures for the upcoming price adjustment have yet to be finalized.

Globally, Brent crude oil prices have experienced a decline of approximately $0.50, settling at around $72.27 per barrel. Meanwhile, US crude oil prices have decreased by 37 cents. This downward trend in global oil prices has created an optimistic outlook for Pakistani consumers, as it signals potential relief at the fuel pumps.

In light of these developments, consumers are advised to remain patient and await official confirmation from the government regarding the adjustments in petrol and diesel prices.

The federal government reviews and adjusts fuel prices biweekly, taking into account fluctuations in international oil prices, exchange rates, and domestic demand.

Current petrol, diesel prices in Pakistan

On September 15, the government announced a reduction in fuel prices effective from September 16. According to a notification from the Finance Ministry, petrol prices have been decreased by Rs10 per litre, bringing the new price to Rs249.10 per litre, while high-speed diesel (HSD) has been reduced by Rs13.6 per litre, now costing Rs249.69 per litre.

Additionally, kerosene oil prices have dropped by Rs11.15 per litre, setting the new rate at Rs158.47 per litre.

Govt announces massive reduction in petrol, diesel prices

A sigh of relief for inflation-stricken masses as Prime Minister Shehbaz Sharif-led government on Sunday announced a massive reduction in petrol and diesel prices from September 16 for the next fortnight.

According to a notification issued by the Finance Ministry, the price of petrol has been reduced by Rs10 per litre, while high-speed diesel (HSD) has seen a reduction of Rs13.6 per litre.

With the adjustment, the price of petrol now stands at Rs249.10 per litre, while the new price of high-speed diesel is set at Rs249.69 per litre.

The government also announced a reduction in kerosene oil prices by Rs11.15 per litre, bringing the new rate to Rs158.47 per litre.

The reductions will be effective for the next fortnight, providing temporary relief to consumers as global fuel prices fluctuate.

Petrol price in Pakistan may drop from Sept 1

In a potential relief for the inflation-stricken populace, Prime Minister Shehbaz Sharif-led federal government is expected to announce a reduction in petrol and diesel prices by up to Rs6 per litre for the first half of September 2024.

This anticipated decrease follows a notable dip in global crude oil prices, which have dropped by $2 to $2.30 per barrel.

Sources within the oil industry have indicated that the reduction will likely see the price of petrol decrease from Rs260.96 to Rs254 per litre, while high-speed diesel (HSD) may drop from Rs266.07 to Rs261 per litre.

However, it is important to note that there has been no official confirmation from the federal government or the Oil and Gas Regulatory Authority (OGRA) regarding the new rates.

OGRA is scheduled to review the prices on August 31, after which they will present their proposal to the government for final approval.

Current petrol, diesel prices in Pakistan

The current price of petrol, at Rs260.96 per litre, was set in mid-August following a reduction of Rs8.47 ahead of Pakistan's Independence Day.

How much token tax will have to be paid on 1000cc cars?

The Punjab government has announced a 10% discount on vehicle token tax payments made through the ‘ePay Punjab’ app, providing a significant benefit for vehicle owners.

This initiative aims to encourage the use of the app for tax payments, reducing the need to stand in long queues at government offices.

The discount on token tax payments through the ePay Punjab app is available until September 30, 2024. Vehicle owners are encouraged to take advantage of this offer by using the app to pay their taxes quickly and conveniently from their phones.

Token tax on new vehicles

In the fiscal budget for 2024-25, the provincial government has introduced a new token tax policy for vehicle owners. Under this policy, if a vehicle has an engine power of up to 1000 cc, the new owner must pay the entire token tax upon transfer of ownership.

Annual token tax

The new regulations state that the annual vehicle token tax will now be based on the invoice value of the vehicle rather than engine power (cc). Vehicles with an engine capacity between 1000 cc and 2000 cc will be taxed at 0.2% of the invoice value annually. For vehicles with an engine capacity above 2000 cc, the tax rate will be 0.3% of the invoice value per annum.

Lifetime token tax

The lifetime token tax for vehicles up to 1000 cc has been increased from Rs 15,000 to Rs 20,000. If ownership of a 1000 cc vehicle is transferred, the new owner will be required to pay the lifetime token tax. A 10% annual discount will be applied if the transfer occurs within 10 years. However, no lifetime token tax will be levied if the transfer takes place after 10 years.

Car sales decline after new vehicle tax in budget 2024-25

The automobile sector in Multan is reeling from a severe crisis following the implementation of a new tax on vehicles in the federal budget 2024-25.

The advance tax, levied at a rate of 0.2% on vehicle invoices, has caused a significant increase in car prices, leading to a dramatic slowdown in business.

Impact on car dealers, buyers

Car dealers and enthusiasts across Multan are expressing their frustration and concern over the new tax. The increase has not only affected the sale of new vehicles, but also the prices of existing inventory, putting a strain on their businesses.

Also Read: Cement, construction material prices surge after strike, taxes

Rana Kaleem, vice president of the Car Dealers Association, highlighted the issue: "Earlier, there was a fixed tax, but now it has been added to the invoice. Although it is 0.2%, it varies for each vehicle and is not negligible."

He further said that the withholding tax already imposed has also been increased, which has had an adverse effect on the business.

Buyer concerns

Potential car buyers are facing significant challenges due to the tax increase. Muhammad Imran, a local citizen, shared his frustration:

"I have been visiting showrooms for four days, but I cannot find affordable Japanese cars. The prices of the available ones are so high that I cannot buy them, and the rates of local cars have also increased."

Business slowdown

Car dealers report that the new invoice tax has led to an increase in car prices, severely affecting their business. The once-thriving market for both new and old vehicles has come to a near standstill, with fewer buyers able to afford the increased costs.

Major challenges: Govt informs IMF of revised budget 2024-25 targets

The coalition government has informed the International Monetary Fund (IMF) about significant changes in the new budget, indicating a major financial challenge for the fiscal year 2024-25.

According to officials from the Ministry of Finance, the net government income is projected to decline by Rs1,258 billion, decreasing from Rs10,377 billion to Rs9,119 billion. This decline is expected to increase the financial deficit to Rs9,758 billion, surpassing the initial target of Rs8,500 billion. The budget deficit is expected to increase by Rs1,258 billion this fiscal year.

Sources within the ministry attribute the need to revise these targets to a significant drop in non-tax revenue. The budget originally set a non-tax revenue target of Rs4,845 billion, which has now been revised downward to Rs3,587 billion. Specifically, the State Bank's profit is now anticipated to be Rs1,258 billion, down from the previous estimate of Rs2,500 billion.

Also Read: Pakistan records $1.9 billion in foreign investment for FY 2023-24

To address the budget deficit, the government plans to secure additional local and foreign loans. The estimated increase in government loans for this financial year is Rs8,489 billion. Despite this, the debt-to-GDP ratio is expected to remain at 64%, with total government debt projected to reach Rs79,731 billion.

The Ministry of Finance also projects that Rs9,775 billion will be spent solely on interest payments for the loans in the current financial year. However, considering a provincial surplus of Rs1,217 billion, the federal budget deficit could be limited to Rs8,541 billion.

Also Read: Inflation continues to climb in Pakistan

Additionally, the government expects to receive Rs1,281 billion from the Petroleum Development Levy, which will contribute to managing the deficit.

In summary, while the government aims to keep the debt-to-GDP ratio stable, the significant drop in revenue and increased reliance on loans highlight the fiscal challenges ahead for Pakistan. The revised budget figures and strategies to manage the deficit will be crucial in the government's financial planning and negotiations with the IMF.

Samsung phones latest prices in Pakistan after new taxes

The recent budget for the fiscal year 2024-25 has brought significant changes to the pricing of Samsung phones in Pakistan.

With the government imposing an 18% sales tax on Samsung and other mobile devices, consumers are now facing higher costs for their favourite gadgets.

Samsung, known for its reliable and diverse range of smartphones, from budget-friendly to high-end models, has become a popular choice among Pakistanis. The brand's strong reputation for quality and innovation has made it a household name in the country.

However, the new tax regulations have affected the prices of several Samsung models, making them less accessible for many.

Here is a detailed comparison of the old and new prices for various Samsung models in Pakistan:

| Device | Old Price (PKR) | New Price (PKR) |

|---|---|---|

| Samsung A25 8/256GB | 90,500 | 98,500 |

| Samsung A35 8/256GB | 104,999 | 119,999 |

| Samsung A55 8/256GB | 120,999 | 139,999 |

| Samsung A34 8/256GB | 114,999 | 116,999 |

| Samsung A54 8/256GB | 140,999 | 140,999 |

| Samsung S23 ULTRA 256GB | 339,999 | 382,999 |

| Samsung S24 256GB | 269,999 | 289,999 |

| Samsung S24 ULTRA 12/256GB | 399,999 | 434,999 |

| Samsung S24 ULTRA 12/512GB | 434,999 | 469,999 |

| Samsung S24 Ultra 12/1TB | 474,999 | 541,999 |

| Samsung Z Flip 5 256GB | 334,999 | 368,999 |

| Samsung Z Fold 5 256GB | 559,999 | 626,999 |

| Samsung Z Flip 5 512GB | 359,999 | 399,999 |

| Samsung Z Fold 5 512GB | 599,999 | 656,999 |

The increase in prices is a result of the government's efforts to reform various sectors, including the technology industry. While these reforms are aimed at boosting revenue and ensuring economic stability, they have also led to a rise in the cost of essential electronic goods.

NEPRA approves massive increase in power tariff

Pakistanis grappling with inflation received another blow as the National Electric Power Regulatory Authority (NEPRA) announced a massive hike in power tariff.

The new tariff translates to a hike of Rs 3.32 per unit, which will directly impact household and business budgets. This is likely to put a strain on many citizens already struggling with rising costs of essential goods.

The adjustment aims to account for fluctuations in fuel prices, which directly affect electricity generation costs. However, this increase comes at a challenging time for consumers, who are already facing rising prices for essential goods and services.

NEPRA’s notification outlines the specifics of the rate change, which will be reflected in upcoming electricity bills. The regulatory authority periodically reviews and adjusts electricity prices based on various factors, including changes in fuel costs.

Federal Cabinet

Earlier, federal cabinet had approved a substantial increase in the basic power tariff by PKR 5.72 per unit. This decision, made through a circulation summary, was forwarded to the National Electric Power Regulatory Authority (NEPRA) for uniform tariff implementation.

The Power Division submitted an application to NEPRA for the tariff hike, which is set to take effect on July 1, 2024, for the fiscal year 2024-2025. The average basic electricity tariff will rise from PKR 29.78 to PKR 35.50 per unit.

NEPRA's recent report highlighted a significant PKR 403 billion loss in Pakistan's power sector for the financial year 2022-2023. This loss was attributed to line losses and low recovery rates from nine power distribution companies, including K-Electric, which failed to achieve 100% recovery. The report also noted that these companies did not purchase electricity as per their assigned quotas, leading to deliberate load-shedding.

20% increase in national tariff

In June, NEPRA announced a nearly 20% increase in the uniform national tariff, aimed at securing approximately PKR 3.8 trillion in funding for the 10 ex-Wapda electricity distribution companies (Discos) for the fiscal year 2024-2025. This adjustment is expected to generate an additional PKR 485 billion in revenue for Discos, aiding the government in securing an IMF bailout scheduled for July.

NEPRA clarified that the government retains the authority to apply varying rates of increase across different consumer categories through cross-subsidies, ensuring the overall revenue requirements set by the regulator remain unaffected.

Govt jacks up petrol by Rs7.45, diesel Rs9.56 per litre

In another jolt for inflation-hit masses, Prime Minister Shehbaz Sharif-led federal government on Sunday increased petrol price by Rs7.45 and diesel price by Rs9.56 per litre.

The Ministry of Finance in an issued notification stated that " The prices of Petroleum products have seen an increasing trend in the international market during the last fortnight.

It added that The Oil & Gas Regulatory Authority (OGRA) has worked out the consumer prices, based on the price variations in the international market.

There will be no change in the applicable taxes & duties, which will remain at the existing level. The prices of Motor Spirit & HSD for the next fortnight, starting from 01st July, 2024.

Earlier on June 15, the government announced a reduction in petroleum prices as a special gift to the public for Eid-ul-Adha.

Following the reduction the new petrol was priced at Rs258.16 per litre, while HSD stands at Rs267.89 per litre.

Petroleum development levy

Earlier today, Finance Minister Muhammad Aurangzeb clarified that the Petroleum Development Levy (PDL) is not increasing at present, and the current rate of 70 rupees PDL will not be applicable.

The FinMin's press conference highlighted the government's commitment to economic stability and transparency through ongoing reforms and initiatives.

The measures outlined aim to foster investor confidence, curb corruption, and ensure sustainable growth for Pakistan's economy.

President Zardari signs Finance Bill; approves federal budget 2024-25

President Asif Ali Zardari signed the Finance Bill 2024 approving the federal budget 2024-25.

A signed copy of the Finance Bill will also be sent to Parliament. The new federal budget will come into effect from July 1

On June 28, the National Assembly passed the federal budget amid opposition protests.

The National Assembly, in a session chaired by Speaker Ayaz Sadiq, approved the federal budget worth Rs18.877 trillion. However, the session saw a walkout by the opposition after they were not allowed to speak on their objections during the passage of the financial bill.

Despite the opposition's protest, the assembly passed the provision to increase the tax rates on international air travel tickets. From July 1, passengers travelling in economy and economy plus classes must pay an additional tax of Rs12,500 on international tickets.

Tax hikes are more substantial for travellers in business, club, and first-class. The ticket tax rate for travel to North, Central, and South America has been increased to Rs350,000. Additionally, the tax on business and club class tickets for the USA and Canada has risen to Rs100,000.

For those travelling to the Middle East and Africa, there will be an additional tax of Rs30,000 on business, first, and club class tickets. Similarly, a tax of Rs210,000 will be levied on business, first, and club class tickets for air travel to Europe. The same tax rate applies to travel to the Far East, Australia, and New Zealand.

The budget's approval marks a significant step in the government's fiscal plan, despite the contention and walkout from opposition members who felt their concerns were not addressed.

Must Read:

Federal budget 2024-25 key points

Salaries, pension increase update in federal budget 2024-25

Air tickets get more expensive after tax hike

In the latest budget for 2024-25, air travel costs are set to rise massively, particularly for those flying in business and club class.

Starting from July 1, the government has introduced new excise duties on air tickets to various international destinations.

These changes take effect on July 1st and will be felt most by travelers heading to destinations like the United States, Canada, North and Latin America. The excise duty for these routes has jumped significantly, from Rs 250,000 to Rs 350,000. That's a cool Rs 100,000 extra you’ll need to shell out for that premium flying experience.

Europe isn’t spared either. Business class flights to European countries will now come with a Rs 210,000 duty, up from the previous Rs 150,000. This represents a Rs 60,000 increase for those hoping to explore European destinations in style.

Travelers to New Zealand and Australia will also face a similar Rs 60,000 duty hike, bringing the total to Rs 210,000. And it’s not just long-haul trips that are affected. The duty on business class tickets to popular Asian destinations like China, Malaysia, and Indonesia has also been raised to Rs 210,000.

Meanwhile, travelers to Saudi Arabia, UAE, the Middle East, and African countries will now pay an additional Rs 30,000, with the new excise duty totaling Rs 105,000. These changes reflect the government’s strategy to increase revenue through higher taxes on luxury travel options.

National Assembly passes federal budget 2024-25 amid Opp walkout

The National Assembly, in a session chaired by Speaker Ayaz Sadiq, approved the federal budget worth Rs18.877 trillion. However, the session saw a walkout by the opposition after they were not allowed to speak on their objections during the passage of the financial bill.

Despite the opposition's protest, the assembly passed the provision to increase the tax rates on international air travel tickets. From July 1, passengers travelling in economy and economy plus classes will be required to pay an additional tax of Rs12,500 on international tickets.

For travellers in business, club, and first-class, the tax hikes are more substantial. The tax rate on tickets for travel to North, Central, and South America has been increased to Rs350,000. Additionally, the tax on business and club class tickets for the USA and Canada has risen to Rs100,000.

For those travelling to the Middle East and Africa, there will be an additional tax of Rs30,000 on business, first, and club class tickets. Similarly, a tax of Rs210,000 will be levied on business, first, and club class tickets for air travel to Europe. The same tax rate applies to travel to the Far East, Australia, and New Zealand.

The budget's approval marks a significant step in the government's fiscal plan, despite the contention and walkout from opposition members who felt their concerns were not addressed.

Also Read: Federal Budget 2024-25 Key Points

Other several key amendments to the federal budget were also approved amidst significant developments and debates.

An amendment to enhance the powers of Federal Board of Revenue (FBR) officers for sales tax audits was approved. Under this new provision, FBR officers will have access to all relevant records and data necessary for conducting tax audits.

During a sales tax audit, individuals or competent authorities must be present, and the FBR cannot request records older than six years. Furthermore, a new tax fraud investigation wing will be established within the FBR to address tax evasion and fraud.

Also Read: Salaries, pension increase update in federal budget 2024-25

This wing will consist of a chief investigator, senior investigators, a senior forensic analyst, a senior data analyst, and other staff members. The unit will include a fraud investigation unit, a legal unit, and an accounts unit, focusing on preventing and investigating tax fraud.

Amendment to increase parliamentarians' privileges

The Pakistan Peoples Party (PPP) presented an amendment to increase the privileges of parliamentarians, which sparked opposition.

Despite this, the National Assembly approved the amendment related to the salaries and allowances of members by a majority vote. The Parliamentarians Salaries and Allowances Act is being amended through the Finance Bill.

Also Read: Govt sets ambitious economic targets in Federal Budget 2024-25

Presented by Abdul Qadir Patel of the PPP, the amendment increases the travelling allowance for lawmakers from Rs10 per km to Rs25 per km.

Additionally, unused air tickets of the MNAs could be utilized in the following year instead of being cancelled. The authority over salaries and allowances of lawmakers is now entrusted to the finance committee of the respective House, rather than the federal government.

Amendments on Petroleum Levy

An amendment regarding the petroleum levy, presented by the finance minister, was passed by a majority vote, with 170 votes in favour and 84 against.

Also Read: Budget 2024-25: Govt allocates Rs2.122 trillion for defense

This amendment sets the maximum limit of the petroleum development levy at Rs50 per litre for light diesel and kerosene, and at Rs70 per litre for petrol and diesel.

Shehbaz Sharif's Speech

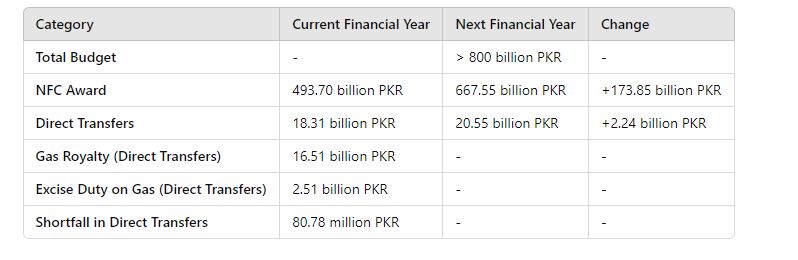

Prime Minister Shehbaz Sharif addressed the National Assembly, emphasizing the historical significance of the National Finance Commission (NFC) award. He recalled that the NFC award was a joint agreement by all four provinces during the tenure of former prime minister Yousuf Raza Gilani and President Asif Ali Zardari.

Prime Minister Sharif highlighted his personal involvement in the NFC award discussions.

No tax imposed on Punjab for first time in history: Maryam

Punjab Chief Minister Maryam Nawaz addressed the Punjab Assembly amid opposition clamour and informed the House about her government's initiatives.

She stated that the Punjab government had completed 100 days, while the opposition raised slogans of 'Zulm ke ye zaabte, hum nahi maante'. Maryam Nawaz addressed them and told them to sit down or their throats will get sore.

She further said the government had presented its first budget for the fiscal year 2024-25, claiming it to be the largest budget in the history of Punjab. She further claimed that no tax was imposed on the people of the province for the first time.

The chief minister said it was impossible for her to summarize the work her government did in 100 days in a single budget speech, She said she knew the opposition members were under pressure because they had something to say. She reminded the House she had said it was a double challenge for her to run this government as there had been chief ministers like Nawaz Sharif and Shehbaz Sharif here, who shaped the destiny of the people of Punjab.

Maryam Nawaz stated that after three months of performance, the former Pakistan Tehreek-e-Insaf government had got an advertisement published in the newspapers claiming to be busy, while they were engaged in seeking revenge and not in serving the nation.

She further said whether Imran Khan gets the necessary facilities in jail, including desi chicken and exercise machines, there should be no abuse from their end.

The CM said that the implementation of the development plans they presented will commence today following the approval of the budget, adding that such a young and educated cabinet has never been seen as the one sitting here. The promises made today in the budget will be fulfilled within a year. "They should have been ashamed of themselves when they were attacking their own nation," she remarked.

She further claimed that the amount her government was going to spend on health and education has never been done in the past.

Maryam claimed that inflation had been reduced to a great extent today, adding that people had heaved a sigh of relief after years of the opposition's incompetence. Flour, bread, sugar, ghee, vegetables, and bakery products have all come down and hospitals have once again started providing free medicine, which had been stopped by the opposition.

She said she had inherited a Punjab where people were involved in corruption, and where no file is processed without bribery.

The CM said that Punjab is the only province where the price of roti has not just been reduced but is also implemented uniformly in the entire province. A bag of 10kg flour cost Rs1,380 in March, whereas it is currently available at Rs800. She lamented that other provinces announced Rs12, Rs13 per roti but could not ensure its availability. Addressing the opposition, she asked them to reduce the price of roti in Khyber Pakhtunkhwa.

She also claimed that the Punjab administration worked for 18 hours, which was called real service to the people. "The people of Punjab have communicated their satisfaction to me through messages," she added. Maryam also mentioned that a program, 'Maryam Ki Dastak', had been started under which facilities were delivered to the doorsteps of the people.

This included the historic Rs30 billion Ramazan package, while health facilities were delivered at the doorstep. She added that the program started with 10 services and later 65 more were added to it in three months.

The chief minister said that key performance indicators have been formulated for the deputy commissioners and commissioners, and she personally presided over their meetings. "They are all examined on each indicator and their scorecards are maintained. We have also introduced a culture of competition among district administrations," she remarked.

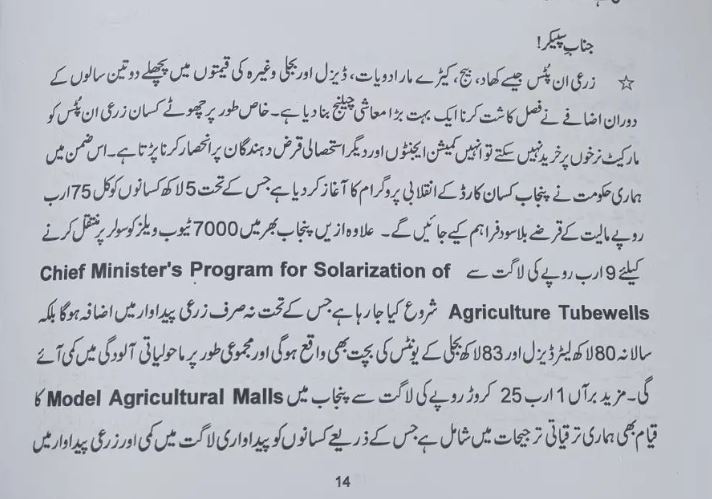

He stated that historical farmers are bringing a package of 400 billion rupees, whereby agricultural reforms will provide all facilities under one roof. Farmers will receive one and a half lakh rupees for interest-free loans, funds for seeds, and medicines. I would like to inform farmers not to be seduced by anyone, as they will experience great prosperity in the near future.

She further said that a historic Rs400 billion farmers package was being introduced through which agriculture reforms will provide all facilities under one roof. She added that farmers will get Rs150,000 interest-free loans, and money for seeds and medicines. She vowed that farmers will be very prosperous in the coming future.

CM Maryam said that in the first phase of the introduction of modern agriculture, the government was providing threshers and super seeders at discounted prices to the farmers. In this project of Rs8 billion, the Punjab government is paying 60%, and the farmers will have to pay the remaining 40%. “We are going to start agriculture solarization,” she announced.

Maryam said that the children of the rich studied in schools by paying millions of rupees in fee, adding that Punjab will launch schools of the same standard. In this regard, the Nawaz Sharif Children's Library Complex is being established in Lahore, in which they will start elementary education, pre-school learning, and arrange specialized teachers.

The chief minister also announced that the Punjab government was going to announce a ‘Himmat Card’ for the handicapped, so they did not become a burden on their family. Under the scheme, such people will get a good amount of money for three to four months as well as wheelchairs.

She said there was so much poverty that children did not have breakfast before going to school and fell unconscious around 11am. “We are going to launch a ‘free milk’ programme for children studying in government schools from pre-school to Grade V. Under this Rs27 billion project, when schools reopen after summer vacation, all children will get free milk,” she announced.

Maryam Nawaz said that Prime Minister Shehbaz Sharif was going to restart the laptop scheme at Rs10 billion. Additionally, Google International is going to impart digital skills to more than 300,000 children every year.

She further said that it was decided to convert school grounds into a community sports grounds, which would be used by the entire population of the area in the evenings.

The CM said they are starting the biggest tractor scheme in history with Rs30 billion. She further declared that she would not be blackmailed, whether it is the YDA or anyone else. “I will not let patients suffer. Two air ambulances are coming to Punjab this week,” she added.

Pakistan’s development budget slashed by Rs 250bn amid IMF pressures

Federal Planning Minister Ahsan Iqbal has announced a significant cut of Rs 250 billion in Pakistan’s development budget even before its approval by parliament.

Speaking about the decision, Minister Ahsan Iqbal cited stringent conditions imposed by the International Monetary Fund (IMF) for the new economic program as the reason behind this reduction.

Addressing the media, Ahsan Iqbal expressed the challenges faced by the government, including poverty, lack of education, and mismanagement of resources.

He highlighted that the original Public Sector Development Program (PSDP) budget of Rs 1400 billion has now been slashed to Rs 1150 billion due to these economic constraints.

The minister emphasized that the current economic situation leaves no room for alternative choices and requires resource mobilization to address pressing financial issues.

He clarified that the decision to cut the development budget aims to alleviate the burden on the people and agricultural sectors, preventing the necessity for additional taxes.

Ahsan Iqbal mentioned the possibility of revising and potentially increasing the development budget in the upcoming financial year to better meet national economic needs.

GB govt presents Rs 1.402 trillion budget for 2024-25

In a dramatic session at the Gilgit-Baltistan Assembly, chaos erupted as the budget for the fiscal year 2024-25, amounting to over Rs 1.402 trillion, was tabled for approval.

The proceedings, chaired by Speaker Nazir Advocate, quickly spiraled into unrest as opposition members vociferously protested and even tore copies of the budget documents.

Before Finance Minister Engineer Muhammad Ismail could deliver his budget speech, opposition leaders surrounded both the speaker’s desk and the finance minister himself, creating a tumultuous atmosphere with constant noise and even the sound of a bugle blaring.

Despite the disruptions, Minister Ismail managed to present a comprehensive budget totaling Rs 1.402 trillion.

Presenting the budget in the provincial assembly, Finance Minister Engineer Ismail said Rs 86.6 billion was allocated for non-development expenditures and Rs 34.5 billion for development projects.

“The development budget includes Rs 20 billion for the annual development programme and Rs 13.5 billion for the Federal Government projects,” he said.

The minister said in order to provide to relief to the GB people, a significant amount of Rs 19.07 billion was earmarked for wheat subsidy.

He announced budgetary allocations for various departments. The education sector got Rs 1.37 billion, health sector Rs 1.52 billion, agriculture department Rs 597.9 million, food department Rs 998 million, tourism department Rs 260 million, mineral resources department Rs 110 million, irrigation department Rs 1.728 billion, forestry and environment department Rs 1.524 billion, rural development department Rs 1.19 billion, information technology department Rs 1.316 billion, technical education department Rs 7.763 billion, social welfare department Rs 3.632 billion, power department Rs 2.88 billion, communication department Rs 5.63 billion, and information department Rs 41.4 million.

Additionally, Rs 536.8 million was specified for the prison department, Rs 192.6 million for law department and Rs 57.4 million for excise and taxation department.

The minister also announced an adhoc relief of 25 percent for grade 1-16 government employees and 20 percent for grade 18 and above.

FBR, finance ministry under fire for 18% GST on children's nutrition

The Senate Standing Committee on Finance has raised serious concerns about the proposed tax measures in the budget for the next fiscal year, warning that they will fuel inflation in the country and increase malnutrition.

The committees recommendations to finance ministry and FBR will include withdrawal of 18% GST on child nutrition products, according to news reports in the media.

Committee chairman Senator Saleem Mandviwalla made these remarks during the committee meeting on Saturday. Criticising the imposition of taxes on basic food items, the committee rejected the proposed taxes on locally produced baby food and infant nutrition, as well as packaged milk.

The budget drew ire from lawmakers from both the ruling PML-N and PPP, as well as opposition Senators, with FBR being criticized for heavy taxation on essential items, as it will make life difficult for the common man.

The committee rejected the proposal to impose an 18 percent sales tax on baby milk, with members voicing concerns about how such a measure could be allowed in a country with a 40 percent stunting rate. PML-N Senator Anusha Rehman and PPP Senator Sherry Rehman both criticized the increase in sales tax on milk as cruel and noted that no consultation was held before making the decision.

In his budget speech, Finance Minister Muhammad Aurangzeb emphasized the vital importance of nutrition during the first 1,000 days of a child's life and the urgent need to address stunting. However, industry experts see the proposed 18% GST on locally produced infant formula, baby food, and child nutrition milk powders as counterproductive and misaligned with the government's stated goals.

In earlier meetings, industry representatives cognizant of the challenges being faced by the economy suggested three-year phase-wise general sales tax as a win-win solution for both the government and the industry, with the 5% on Y1, 10% Y2 and 18% on Y3.

Amid high inflation, it is crucial to recognize that locally produced infant formula, baby food, and fortified child nutrition milk powders are approximately 50% less expensive than imported versions, making them more affordable for the general population and less burdensome on foreign exchange reserves.

Petrol, diesel prices in Pakistan likely to go up from July 1

Prime Minister Shehbaz Sharif-led federal government is poised to announce a substantial hike in petrol prices, effective July 1, in line with the implementation of the Budget 2024-25.

This will be the first price revision since the budget for the fiscal year 2024-25 was presented on June 12.

In the recently proposed Finance Bill 2024, the government has introduced a notable increase in the maximum petroleum levy, raising it by Rs20 to Rs80 per litre.

This adjustment is expected to have a significant impact on petrol and high-speed diesel (HSD) prices nationwide.

Current petrol, diesel prices in Pakistan

Currently, petrol is priced at Rs258.16 per litre, while HSD stands at Rs267.89 per litre, following a reduction earlier this month by Rs10.20 and Rs2.33, respectively. However, with the new levy, these prices are anticipated to rise sharply.

Petroleum levy

The petroleum levy has been identified as a crucial revenue stream for the government, which is seeking to bolster its finances and secure another bailout package from the International Monetary Fund (IMF).

This move aims to enhance the government’s revenue, targeting Rs12.97 trillion for the Federal Board of Revenue (FBR) in the upcoming fiscal year.

Market analysts predicted that the increase in the petroleum levy will directly translate to higher fuel costs for consumers. The precise extent of the price rise will be confirmed on June 31, when the government finalizes the revision.

The expected surge in fuel prices comes at a time when the public is already grappling with inflationary pressures, and this development is likely to exacerbate the economic burden on households and businesses alike.

How much will Balochistan govt employees’ salaries increase?

The Balochistan provincial cabinet, under the leadership of Chief Minister Sarfraz Bugti, has given its nod to the budget proposals for the upcoming fiscal year 2024-2025.

This decision includes significant increases in salaries for government employees and prioritizes sectors like health and education.

During a crucial budget meeting chaired by Chief Minister Sarfraz Bugti, the Finance Department presented its recommendations.

It highlighted that enhancing salaries for government employees is a focal point, with a proposed 25% increase for employees from Grade 1 to Grade 16. Meanwhile, employees from Grade 17 to Grade 22 are slated to receive a 22% raise.

In addition to salary increments, the budget allocates Rs 13 billion for pensions and other benefits, underscoring the government's commitment to supporting retired personnel.

The education sector is set to receive Rs 126.26 billion, aiming to bolster educational infrastructure and quality across the province. Furthermore, Rs 57.12 billion has been earmarked for the health sector to improve healthcare services.

The provincial cabinet also approved the introduction of a pension country scheme during the meeting, reflecting the government's efforts to address long-term financial security for retired individuals.

Balochistan cabinet approves budget for 2024-25

The Balochistan provincial cabinet, led by Chief Minister Mir Sarfraz Bugti, on Friday, approved the budget proposals for the upcoming fiscal year 2024-25.

The provincial finance department briefed the cabinet, emphasizing that health and education sectors remain top priorities in the new budget.

The budget also focuses on agriculture, livestock, and mineral and mines development, with significant allocations for each. During the meeting, the cabinet approved a new pension scheme aimed at benefiting government employees.

Chief Minister Bugti highlighted a historic move in Balochistan's budget planning, stating that for the first time, 70% of approved development projects are included in the budget proposals. He directed that work on new fiscal year development projects should commence from the first month to ensure timely progress.

Bugti urged provincial ministers and assembly members to personally oversee development projects within their departments and constituencies. He warned that departments showing slow progress would not receive additional funds, while those completing projects on time would be encouraged and supported.

Budget outline

The new budget outlines substantial allocations across various sectors to address public needs and promote development. A total of Rs 138.40 billion has been earmarked for general public services, and Rs 93.12 billion has been designated for maintaining law and order.

Economic affairs departments are set to receive Rs 79.36 billion, while Rs 0.90 billion is allocated for environmental protection. Housing and community facilities will benefit from Rs 49.92 billion, and the health sector will receive Rs 57.12 billion.

Additionally, the budget includes Rs 6 billion for entertainment, tourism, culture, and religious affairs. The education sector is allocated Rs 126.26 billion, and social protection is set to receive Rs 13.35 billion. Loan repayments are allocated Rs 8.65 billion, and pensions and other obligations will receive Rs 13 billion.

The development budget, sourced from provincial resources, is allocated Rs 219 billion. This includes Rs 28.28 billion for foreign development projects and Rs 73.28 billion for federal development projects.

Balochistan budget 2024-25: Salaries to be increased up to 25%

Today, all eyes are on Quetta as the Balochistan Assembly prepares for the presentation of the budget for the financial year 2024-25.

Provincial Finance Minister Mir Shoaib Nausherwani is set to unveil the budget at 4pm in the assembly. Prior to that, a meeting of the provincial cabinet regarding the budget of the next financial year will be held at 3pm.

The budget session of the assembly, scheduled from June 21 to 29, will not only feature the presentation of the main budget but also include discussions on a supplementary budget for the current financial year. This supplementary budget, aimed at addressing immediate fiscal needs, is expected to receive approval during the session.

According to the Balochistan Finance Department, the total size of the budget is proposed to be Rs850 billion. This includes a non-developmental budget proposal of Rs600 billion and a development budget proposal amounting to Rs250 billion.

Health and education sectors are set to receive substantial allocations, with more than Rs67 billion earmarked for health initiatives and a possibility of Rs120 billion allocated towards education reforms.

Also Read: Balochistan's budget 2024-25 to be presented on June 21

Additionally, Rs70 billion are expected to be allocated for peace and security measures, reflecting the province's focus on maintaining stability and enhancing safety.

The budget is also likely to propose Rs2 billion for the Benazir Scholarship program and increase the grant for universities to Rs5 billion.

Furthermore, the proposal is likely to include a significant increase in salaries, with a potential 25% raise for government employees in grades 1 to 16 and a 20% increase for employees in grades 17 to 22.

Under the National Finance Commission (NFC) Award, Balochistan anticipates receiving Rs647 billion, a crucial source of revenue for the province. Additionally, Pakistan Petroleum Limited (PPL) is expected to contribute Rs60 billion to Balochistan, supporting local development initiatives.

The budget approval process will involve discussions and deliberations between government and opposition members to ensure comprehensive consideration of all proposals and priorities.

PM Shehbaz and Bilawal Bhutto agree to continue negotiations

In a bid to ease tensions between the ruling Pakistan Muslim League-Nawaz (PML-N) and its major coalition partner, the Pakistan Peoples’ Party (PPP), Prime Minister Shehbaz Sharif and PPP chairman Bilawal Bhutto Zardari have agreed to continue negotiations at the committee level.

This decision came during a meeting on Thursday where both leaders sought to address and resolve existing grievances.

During the meeting, a PPP delegation led by Bilawal Bhutto Zardari met with Prime Minister Shehbaz Sharif.

He expressed concerns over the non-implementation of the power-sharing agreement, highlighting issues such as the PPP’s limited influence in Punjab and lack of administrative positions and funds. He also pointed out that significant development projects in Sindh were overlooked in the federal budget.

The Prime Minister assured the PPP chairman of addressing all concerns and promised to eliminate any doubts and complaints.

The meeting was attended by key officials, including Speaker Sardar Ayaz Sadiq, Deputy Prime Minister Ishaq Dar, Federal Finance Minister Muhammad Aurangzeb, and Information and Broadcasting Minister Ataullah Tarar.

Declaration

According to a statement from the Prime Minister's Office, the meeting was held in a positive atmosphere. Shehbaz Sharif noted the positive economic indicators, citing the stock market's historic performance as a sign of the business community's confidence in the budget. He emphasized the importance of all political parties working together for the country's development and the welfare of its people.

To further strengthen relations, Prime Minister Shehbaz Sharif hosted a dinner in honor of the PPP delegation.

Inside story

Inside sources revealed that Bilawal Bhutto Zardari voiced his concerns about the unmet promises made during the formation of the government. He specifically mentioned the PPP's challenges in Punjab and the neglect of Sindh's major development projects in the federal budget.

In response, the Prime Minister pledged to form committees to resolve these issues. These committees, comprising members from both the PPP and PML-N, are set to meet today to discuss and move forward with the resolution of these matters.

Umar Ayub slams budget as ‘economic terrorism’ against Pakistan

Pakistan Tehreek-e-Insaf (PTI) leader and Leader of Opposition in the National Assembly Umar Ayub on Thursday vehemently criticized the government’s budget, labeling it as “economic terrorism” against the people and future of Pakistan.

Speaking during the heated session of the National Assembly chaired by Speaker Ayaz Sadiq, he accused the government of robbing the Pakistani populace through its financial policies, describing the budget as a scheme devised by economic hitmen to undermine the country’s stability.

Addressing Finance Minister Muhammad Aurangzeb, Ayub acknowledged his personal respect but criticized the consequences of the budget, which he likened to a betrayal by close associates who have metaphorically “slaughtered the nation.”

The opposition leader emphasized that the budget would shake the foundations of Pakistan’s economy and highlighted the challenges faced in attracting investments due to prevailing lawlessness.

He also invoked historical contexts, mentioning the founder of PTI and his contributions during challenging economic times, contrasting it with the current government’s approach.

Furthermore, Ayub blamed the government for derailing the economy, referencing what he called the “London plan” as a contributing factor to the current economic woes. He highlighted the importance of restoring law and order to attract investments.

He underscored the need for effective governance to restore economic stability and criticised the priorities of government officials, referring to recent incidents involving social media distractions during official visits.

The opposition leader accused the government of manipulating facts and mismanaging the country’s economy. He criticized the administration for its alleged fabrication of economic figures, asserting that under the founding PTI government, Pakistan witnessed a 6 percent growth rate with significant industrial development.

Ayub blamed the current government's policies for allegedly sabotaging this progress, citing negative development budgets, rising unemployment, and inflation spikes.

During his address, Ayub highlighted a substantial increase in loans and a decline in foreign exchange reserves from July 2023 to March 2024. He also criticized the previous administration’s decision to procure wheat worth Rs 450 billion, describing it as ill-considered. Ayub slammed the Public Sector Development Program (PSDP) allocation of Rs 1.4 trillion as mere smoke and mirrors, accusing the government of misleading the public about its development efforts.

The session saw passionate exchanges as Ayub called for accountability and strategic reforms to salvage the country's economic prospects, concluding with pointed remarks about the government's perceived shortcomings and the urgent need for corrective measures.

Referring to the Prime Minister’s recent visit to China, the PTI leader criticized the Deputy Mayor’s TikTok video during the visit, contrasting it with the perceived lack of seriousness in addressing Pakistan's economic challenges.

He lamented the state of lawlessness impacting investment and argued for decisive action to salvage the economy.

Constitution cannot be bulldozed at the behest of IMF: Ali Zafar

Pakistan Tehreek-e-Insaf (PTI) leader and Senator Barrister Ali Zafar on Thursday said that the Constitution cannot be bulldozed at the behest of the International Monetary Fund (IMF).

In a recent Senate session chaired by Deputy Chairman Syedaal Khan Nasar, he voiced strong objections to the proposed budget, claiming it to be detrimental to the country’s economic growth and influenced by the International Monetary Fund (IMF).

The PTI leader criticized the budget as a “recipe for disaster,” emphasizing that imposing a 40% tax would hinder economic growth and disproportionately affect those already struggling to afford basic necessities like medicine and food.

He stressed that without resolving the ongoing political crisis and restoring the mandate, the budget would fail to serve its intended purpose.

Highlighting the negative impact on the property and construction sectors, Zafar argued that the budget was crafted amidst chaos. He criticized the budget’s formulation amid chaos, asserting that the PTI had managed the economy effectively during the COVID-19 pandemic, asserting that the current approach is flawed.

The Senator also placed partial blame on the Election Commission of Pakistan (ECP), accusing it of contributing to political instability. He alleged that the ECP’s actions, including the withdrawal of PTI’s mandate, have led to the present economic turmoil.

Mr Zafar also pointed out the absence of Khyber Pakhtunkhwa senators from the budget session as a significant concern.

Barrister Ali Zafar reiterated that the Constitution should not be compromised under IMF directives, calling for a more balanced and internally-driven economic strategy.

PPP leaders unhappy with government actions

In a crucial consultative meeting held at Zardari House under the leadership of Pakistan Peoples’ Party (PPP) Chairman Bilawal Bhutto, key party figures expressed strong dissatisfaction with the government’s recent actions.

Sources reveal that senior PPP leaders advocated for a firmer stance, highlighting that the party was not adequately consulted during the budget-making process.

Several party leaders criticized the Pakistan Muslim League-Nawaz (PML-N) for disregarding prior agreements with the PPP. They pointed out that the agreed-upon power-sharing formula in Punjab had been violated and that PPP members were unjustly deprived of development funds.

Additionally, the PPP members complained about being excluded from the allocation of development funds.

The sentiment among these leaders was that conceding now would mean that the PPP’s concerns might never be addressed. On the other hand, some participants leaned towards reconciliation and negotiation.

They suggested offering conditional support to the government for passing the budget while continuing dialogue to resolve ongoing issues.

There was a consensus that the future of the PPP-PML-N alliance should be determined through direct discussions between Bilawal Bhutto and the Prime Minister. This approach, they believed, could ensure that the party's grievances are addressed while maintaining a collaborative relationship with the government.

Balochistan's budget 2024-25 to be presented on June 21

Balochistan's Department of Finance has announced that the provincial budget for the fiscal year 2024-25 will be presented in the Balochistan Assembly on June 21.

Provincial Finance Minister Mir Shoaib Nosherwani will table the budget during a session scheduled to commence at 4pm on June 21, according to a notification issued.

In preparation for this significant event, a meeting of the provincial cabinet to discuss the budget details will also convene on the same day. The budget session of the Balochistan Assembly is slated to span from June 21 to 29, according to the Finance Department.

Alongside the main budget presentation, the supplementary budget for the current fiscal year will also be tabled and subsequently approved by the House during this session.

A debate on the proposed budget for the upcoming financial year will commence on June 24. The Finance Department anticipates rigorous discussions between government and opposition members, culminating in the budget's final approval.

The upcoming budget session holds considerable importance for the province, setting the financial agenda and priorities for the next fiscal year amidst various economic challenges and development objectives.

Countries run on taxes, not charity: FinMin Muhammad Aurangzeb

Finance Minister Muhammad Aurangzeb extended his heartfelt Eid greetings to the nation and held meetings with farmers and businessmen in Kamalia to discuss ‘achievements’ and challenges faced in the region.

He clarified that countries run on taxes and not from charity.

The Finance Minister noted that agricultural and industrial growth in Kamalia is encouraging.

Minister Aurangzeb reiterated the principles outlined in his budget speech, emphasizing that while charity runs schools, universities, and hospitals, a country's treasury relies on taxes.

The minister stated that the country's economy is on a path to improvement and stressed the importance of balancing the system to sustain growth.

Tax System Enforcement

He announced that efforts are being made to bring more sectors into the tax net, with 31,000 to 32,000 retailers registered. Retailer pre-tax enforcement will begin in July.

Tax Compliance

The Finance Minister highlighted the need for strict enforcement of tax laws, asserting that tax authorities must ensure compliance.

No reduction in govt expenditure

Aurangzeb acknowledged that there has been no reduction in government expenditure and emphasized the necessity to reduce it. He mentioned that certain ministries have been earmarked for closure to cut costs.

Sales Tax Priority

He also indicated a preference for sales tax and mentioned that departments previously not paying taxes are being integrated into the tax system.

Minister Aurangzeb shared his experience of living in the private sector for six years, expressing confidence in understanding the potential and limitations of both sectors.

Finance Minister Aurangzeb conveyed optimism about the country's economic future and reiterated the importance of tax enforcement and government expenditure reduction to achieve sustainable growth.

Balochistan to present Budget 2024-25 with total outlay of Rs850 billion on June 22

Balochistan government is set to unveil its budget for the next financial year on June 22 with totalo outlay of Rs850 billion, with focus on health, education, and agriculture.

Provincial Finance Minister Shoaib Nosherwani will present the budget, emphasizing a reduction in the tax burden on the populace.

Nosherwani assured that the budget will be people-friendly and aimed at addressing the needs of Balochistan’s residents.

“Tax burden on people will be reduced. Despite the difficulties, the people will present a friendly budget,” said Nosherwani.

The budget will prioritize the education, health, and agriculture sectors, with substantial support from the federation to complete ongoing and proposed projects tailored to the province’s requirements.

Provincial Minister for Planning and Development Zahoor Bilidi highlighted the importance of these sectors in the upcoming budget.

Balochistan Budget 2024-25 key points

Health Rs67 billion

Benazir Scholarship program Rs2 billion

Universities grant Rs5 billion

Govt considers rollback of income tax hike amid criticism

In response to widespread public outcry and opposition from various sectors, the government of Pakistan is contemplating a partial rollback of its ambitious tax proposals, particularly concerning income tax hikes on salaried individuals.

The move comes amidst escalating discontent over the proposed fiscal measures aimed at generating additional revenue amounting to Rs 1.5 trillion in the upcoming fiscal year.

The Finance Ministry, led by Muhammad Aurangzeb, has initiated internal consultations following severe backlash from taxpayers and businesses alike. The proposed budget, totaling 18.9 trillion rupees, represents a staggering 30% increase over the current fiscal year, yet faces mounting resistance for its heavy reliance on increased taxes rather than expenditure cuts.

Prime Minister Shahbaz Sharif has been pressed by Finance Minister Aurangzeb to reconsider the substantial burden imposed on the salaried class, which has already contributed 360 billion rupees this year alone. Despite efforts to reduce this burden by 240 billion rupees, an additional 75 billion rupees in income taxes has been earmarked for the upcoming fiscal year.

Exporters, who have traditionally enjoyed a fixed income tax rate of 1%, are also slated to face gradual increases under the new proposals. Critics argue that such measures could jeopardize Pakistan's export competitiveness at a time when global economic uncertainties prevail.

Furthermore, contentious proposals such as an 18% sales tax on baby milk have sparked fierce debate. Stakeholders from the dairy industry warn that such a tax hike, if implemented abruptly, could lead to a significant spike in prices, burdening consumers already grappling with rising costs of living.

The Standing Committee on Finance, chaired by Senator Saleem Mandviwala, has emerged as a vocal opponent of these tax hikes. Mandviwala's committee has recommended a thorough review of the budgetary proposals, particularly the imposition of taxes affecting vulnerable groups like the salaried class and consumers of essential goods.

Chairman FBR, Malik Amjad Zubair Towana, has indicated openness to revisiting the proposed 18% sales tax on baby milk, suggesting a phased implementation instead. Industry leaders, including Nestlé Pakistan's Sheikh Waqar Ahmad, emphasize the potential hardships that an immediate tax hike on baby milk could impose on Pakistani families.

Meanwhile, the government's move to grant Pakistan International Airlines a 10-year deficit adjustment plan has drawn criticism from opposition figures like Senator Mohsin Aziz of Tehreek-e-Insaf. Aziz argues that such measures could amount to hidden incentives for potential buyers of state-owned enterprises, raising concerns over transparency and fiscal accountability.

In addition to tax policy revisions, the government has also proposed stringent measures such as banning non-filers from traveling abroad, a move aimed at expanding the taxpayer base and enhancing revenue collection.

With ongoing deliberations and consultations underway, the fate of these proposed tax revisions hinges on both Pakistan's financial capacity and its obligations under the International Monetary Fund's program, underscoring the delicate balance between fiscal consolidation and public sentiment.

Sindh’s budget sees 34% increase, focuses on development: Murad Ali Shah

Sindh Chief Minister Murad Ali Shah announced that the province’s budget for the current fiscal year is 34% higher than the previous year, highlighting a significant increase in the development budget.

Addressing a post-budget press conference, he said that Sindh’s development allocation surpasses that of other provinces, with efforts underway to cooperate with the federal government in terms of GDP growth.

The Sindh CM said that total budget for Sindh stands at Rs 3,560 billion, with a challenging growth rate target. He pointed out that 31% of the budget is dedicated to development projects, urging the federal government to consider Sindh for development schemes, especially those halted by the caretaker government.

Shah explained that the suspension of development schemes included in the caretaker government’s budget has caused delays, compounded by inflation-driven cost increases.

“The current budget prioritises the rehabilitation of flood victims, with a focus on completing ongoing projects rather than initiating new ones,” he said. However, he assured that growth would still occur within the year.

Out of the total budget, Rs 1,912 billion is allocated for current revenue expenditure, Rs 184 billion for capital expenditure, and over Rs 1,000 billion for development in the next financial year. A major portion of the current revenue expenditure, 70%, is earmarked for salaries, including 38% for current salaries and 14% for pensions and other grants.

The Sindh CM further revealed that Sindh expects Rs 1,900 billion from the federal government, with Rs 619 billion allocated for tax revenue and Rs 43 billion for non-tax revenue. Additionally, around Rs 27.5 billion is projected from current capital receipts, with foreign assistance projects bridging any gaps.

The Chief Minister said the provincial government also announced salary increases for government employees. The minimum wage is proposed to be Rs 37,000. Employees in grades 1 to 6 will receive a 30% pay hike, while those in grades 7 and above will see an increase beyond Rs 37,000. Salaries for grades 6 to 16 will rise by 25%, and grades 17 to 22 will see a 22% increase.

Sindh unveils Rs3.056 trillion budget 2024-25 with 30% salaries hike

Sindh Chief Minister Murad Ali Shah presented the provincial budget 2024-25 with a total outley of Rs3.056 trillion on Friday in the Sindh Assembly budget session.

Murad Ali Shah said he felt privileged to present the 13th budget of the Sindh government as he has been elected for the third term in the February 2024 general elections on the PPP ticket.

- Salaries and Pensions: Increases ranging from 22% to 30% for salaries and a 15% increase in pensions.

- Development Focus: Significant allocation towards development, social services, and rehabilitation efforts.

- Education and Health: Prioritized with substantial budget allocations to enhance services and infrastructure.

- Agriculture and Energy: Specific allocations to support agricultural development and energy projects.

- Social Welfare: Emphasis on social security, housing schemes, and subsidies to reduce financial burdens.

- Law and Order: Special budget for police stations and initiatives for public safety.

Read more: Sindh govt announces 30% salary increase, 15% pension hike

Budget allocation percentage-wise

- Current Revenue Expenditure: 63%

- Current Capital Expenditure: 6%

- Development Expenses: 31%

Sectoral-wise allocation highlights

- Education: Rs 519 billion

- Health: Rs 334 billion

- Local Government: Rs 329 billion

- Agriculture: Rs 58 billion

- Energy: Rs 62 billion

- Irrigation: Rs 94 billion

- Transport: Rs 56 billion

| Sindh Budget 2024-25 Key Points | |

| Total Budget | Rs 3.056 trillion |

| Salary Increase | 22% to 30% |

| Pension Increase | 15% |

| Development Expenditure | Rs 959 billion (31% of total expenditure) |

| Expected Income | Rs 3 trillion |

| Federal Transfer | 62% of income |

| Provincial Receipts | 22% of income |

| Current Capital Receipts | Rs 22 billion |

| Foreign Project Assistance | Rs 334 billion |

| Federal Grants PSDP | Rs 77 billion |

| Foreign Grants | Rs 6 billion |

| Carry Over Cash Balance | Rs 55 billion |

| Provincial Receipts | Rs 662 billion |

| Sales Tax on Services | Rs 350 billion |

| GST Plus Tax | Rs 269 billion |

| Provincial Non-Tax Receipts | Rs 42.9 billion |

| Current Revenue Allocation | 63% (Rs 1.9 trillion) |

| Current Capital Allocation | 6% (Rs 184 billion) |

| Development Expenses Allocation | 31% (Rs 959 billion) |

| Salary Expenses | 38% |

| Grants | 27% |

| Non-Salary Expenses | 21% (operational expenses, relocation, interest payments, repairs) |

| Pension and Retirement Benefits | 14% |

| Debt Repayment | Rs 42 billion |

| Government Investment | Rs 142.5 billion |

| Provincial ADP | Rs 493 billion |

| Foreign Project Assistance | Rs 334 billion |

| District ADP | Rs 55 billion |

| Education Budget | Rs 519 billion (Rs 459 billion for current revenue expenditure) |

| Health Budget | Rs 334 billion (Rs 302 billion for current expenses) |

| Local Government Budget | Rs 329 billion |

| Agriculture Budget | Rs 58 billion (Rs 32 billion for current expenditure) |

| Energy Budget | Rs 62 billion (including Rs 77 billion for ongoing expenses) |

| Irrigation Budget | Rs 94 billion (Rs 36 billion for current expenses) |

| Works and Services Budget | Rs 86 billion |

| Transport Budget | Rs 56 billion |

| SG&CD Budget | Rs 153 billion |

| Social and Economic Welfare | Rs 34.9 billion |

| Subsidies Program | Rs 116 billion |

| Housing Schemes | Rs 25 billion |

| Hari Card for Farmers | Rs 8 billion |

| Malir Express Korangi Enclave Complex | Rs 5 billion |

| Police Budget | Specific budget for 485 police stations |

| Solarization Initiative | Rs 5 billion |

| Hub Canal for Karachi Water Supply | Rs 5 billion |

| Labor Card | Rs 5 billion |

| Agriculture Development | Rs 11 billion |

| Social Security | Rs 12 billion |

| Universities and Boards | Rs 3.2 billion |

| Housing and Town Planning | Rs 2 billion |

| DEPD | Rs 1.5 billion |

| Major Grants for Education and Health | Rs 190 billion |

| Grants for Universities | Rs 35 billion |

Sindh govt announces 30% salary increase, 15% pension hike

The Sindh budget came up with good news for government employees as the PPP-led provincial government increased 22 to 30 percent increase in the salaries of the Sindh government employees.

The Sindh government increased the 30 percent salary for grade 1 to 16 government employees.

It has been decided to increase the salary of officers from grade 17 and above up to 22%.

PPP-led government has decided to increase 15 percent pension of government employees. Sindh government has decided to increase the minimum wage to Rs37,000.

Read more: Sindh to present Rs3.056 trillion budget for 2024-25 today

7% tax on beauty products; lipstick, nail polish, mascara, eyeliner prices to surge

Women across the port city of Karachi expressed dismay over the expected rise in prices for essential makeup items, following the government's decision to increase taxes on cosmetics in the FY2024 budget.

Eyeliner, blush, face powder, foundation, mascara, lipstick, and nail polish are all expected to become more expensive, causing concerns among consumers who rely on these products for their daily beauty routines.

The proposed budget includes a 5 to 7 percent increase in taxes on various facial and beauty-enhancing products, further adding to the financial burden on consumers.

Shopkeepers in the city are also apprehensive, predicting a decline in sales if prices go up as expected.

They emphasize that any increase in costs due to higher taxes will directly impact consumer affordability and purchasing power.

One shopkeeper stated, "If the goods become more expensive, naturally the sales will also decrease."

There is a call for the government to reconsider the tax hike on decorative items, suggesting that relief should be provided to ensure continued access to essential beauty products.

Opposition denounces Punjab budget in turbulent session

In a turbulent session, the Punjab Assembly witnessed a dramatic rejection of the proposed budget for the next financial year by the opposition. The session, marked by chaos and confrontations, underscored the deep divisions within the house.

As Finance Minister Mujtaba Shuja-ur-Rehman began his budget speech, the opposition responded with loud slogans and protests, quickly escalating to the point of surrounding the speaker’s podium.

The uproar continued unabated, with opposition members moving towards the Chief Minister’s seat, prompting ministers and government members to form a protective barrier.

The situation intensified as Provincial Minister Sohaib Bharat and MPA Ghazali Saleem Butt intervened to prevent the opposition from reaching the government benches. At one point, two ministers and opposition members engaged in physical confrontations, further highlighting the fraught atmosphere.

In the presence of Maryam Nawaz, the budget documents were dramatically torn up, symbolising the opposition’s vehement disapproval.

The opposition accused the government of presenting a fraudulent budget, criticising both the federal and provincial governments for failing to provide relief and instead burdening the salaried class with additional taxes.

The session was abruptly adjourned by Speaker Malik Ahmed Khan amidst the ongoing commotion, with the next meeting scheduled for 11 am on Thursday, June 20.

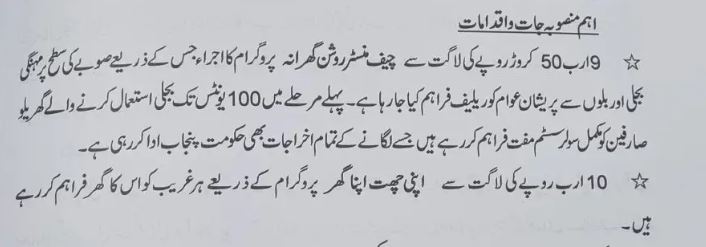

Budget 2024-25: Punjab govt announces free solar systems

The Punjab government has unveiled a budget for the fiscal year 2024-25, which includes a significant initiative to provide free solar systems to low electricity consumers.

This move aims to alleviate the burden of high electricity costs and bills for the province's residents.

According to the budget document, this initiative, called the “Roshan Gharana Program”, is set to alleviate the financial burden of high electricity costs and bills on the province's residents.

The program, with a budget allocation of Rs 9.5 billion, will offer complete solar systems at no charge to domestic users who consume up to 100 units of electricity in the first phase. The Punjab government will cover all associated costs.

Additionally, the budget outlines the Chief Minister's Solarization of Agriculture Tube Wells Program, which will receive Rs 9 billion in funding. This program aims to convert 7,000 agricultural tube wells to solar power, providing significant support to the agricultural sector.

The fiscal year 2024-25 budget was presented today in the Punjab Assembly. During his budget speech, the Finance Minister highlighted that the total budget volume is Rs 5,446 billion, with an estimated total income of Rs 4,643.4 billion. The budget proposes Rs 842 billion for development expenditure, and 77 new mega projects will be included in the annual development plan.

Punjab budget to bring relief, not new taxes, asserts CM Maryam

Punjab Chief Minister Maryam Nawaz assured on Thursday the public that the forthcoming budget will not impose any new taxes.

During a high-level meeting, CM Maryam stressed her commitment to alleviating the financial burden on the people of Punjab, while simultaneously increasing the province's revenue through internal sources.

Chief Minister Nawaz stated, "Our focus is on expanding the financial resources of Punjab without burdening the public. We are exploring innovative ways to boost our revenue streams from within our own capabilities."

She elaborated on the administration's performance-based approach, mentioning that Deputy Commissioners will be appointed strictly on merit. Continuous monitoring and performance assessments will ensure that officials are accountable and effective in their roles.

In a significant infrastructural move, the Punjab's executive announced the establishment of a unified department dedicated to the supply and irrigation of water throughout Punjab. This is part of a broader initiative to modernise and streamline essential services across the province.

A key highlight of the meeting was the ambitious plan to transform Punjab into a safe city. The Chief Minister revealed that comprehensive camera coverage will be implemented in all cities, enhancing security and surveillance capabilities.

Addressing agricultural concerns, Nawaz shared that savings from wheat procurement will be redirected to support farmers. Special attention will be given to the farmers of South Punjab, who will receive livestock aid. This initiative underscores the administration's focus on agricultural development and rural support.

For the first time, rural health centers are receiving unprecedented attention. Maryam Nawaz announced that all health centers will undergo a complete revamp.

There has been a positive response from the public regarding the provision of medicines in field hospitals and the distribution of free medicines in government hospitals.

Furthering her commitment to housing, she introduced the "Apna Chhat Apna Ghar" programme. Under this initiative, financial assistance will be provided to individuals with plots up to 5 marlas to help them build homes, promoting housing development and ownership.

Expressing her gratitude and dedication, Maryam mentioned the encouragement from her father, Nawaz Sharif. "Nawaz Sharif is very happy with our hard work. He believes that Allah's blessings are with us. We are determined to work day and night to fulfill our promises and development plans," she said.

She praised her cabinet and team for their relentless efforts and assured the public of continued dedication to their welfare and the province's development.

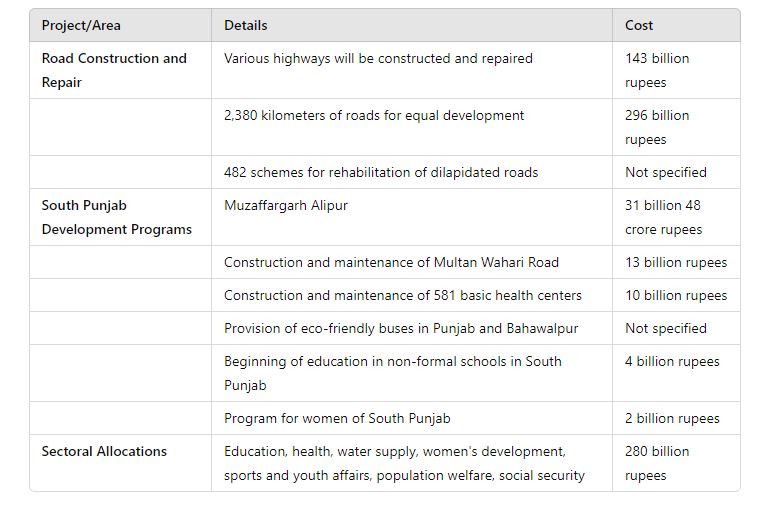

Punjab unveils Rs5.46 trillion tax-free budget

Punjab Finance Minister Mian Mujtaba Shuja-ur-Rehman presented the Punjab budget 2024-25 in an assembly session under the chair of Speaker Malik Ahmed Muhammad Khan amid the opposition protest. The session kicked off with a delay of one hour and 38 minutes.

The budget outlay of Rs5,446 billion, including Rs842 billion allocated for development expenditure and a surplus of Rs630 billion.

Punjab Chief Minister Maryam Nawaz Sharif reached the assembly session.

Opposition members raised slogans against the budget announcements and tore copies of the Punjab budget for 2024-25.

This year the volume of the budget is Rs910 billion more than last FY.

Journalists boycott assembly session

Journalists associations present in the Punjab Assembly session to cover the budget session protested against the Defamation Act passed by the PML-N-led unity government through the provincial assembly.

PPP lawmakers are present in the session.