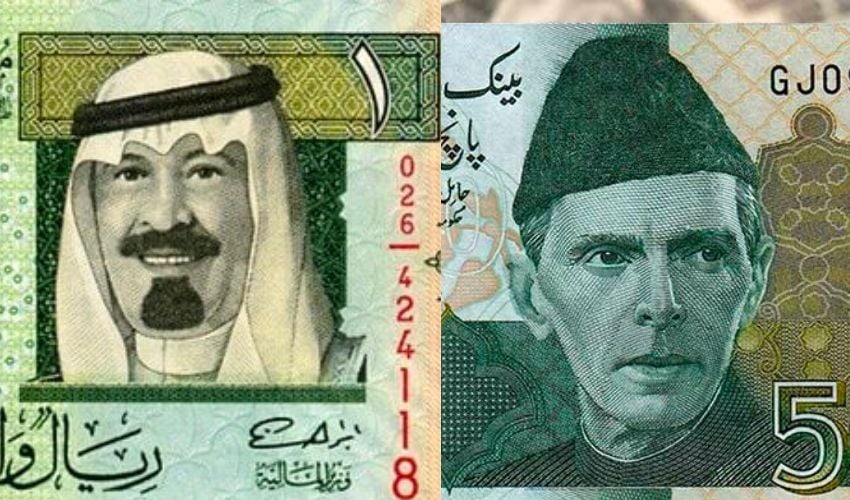

Pakistan Stock Market PSX-100 index recovered after three days of continuous decline and witnessed a bullish trend in the stock market since morning with an increase of 700 points on Wednesday.

The PSX-100 index benchmark also recovered 62,000 points. When the trading started, the benchmark traded up 720 points at 6,1949 points.

It is pertinent o note that on Tuesday, PSX staged a dramatic turnaround after plunging over 1,450 points in the opening few minutes of trading after it was learnt that the International Monetary Fund (IMF) was not on board with the government’s circular debt plan.

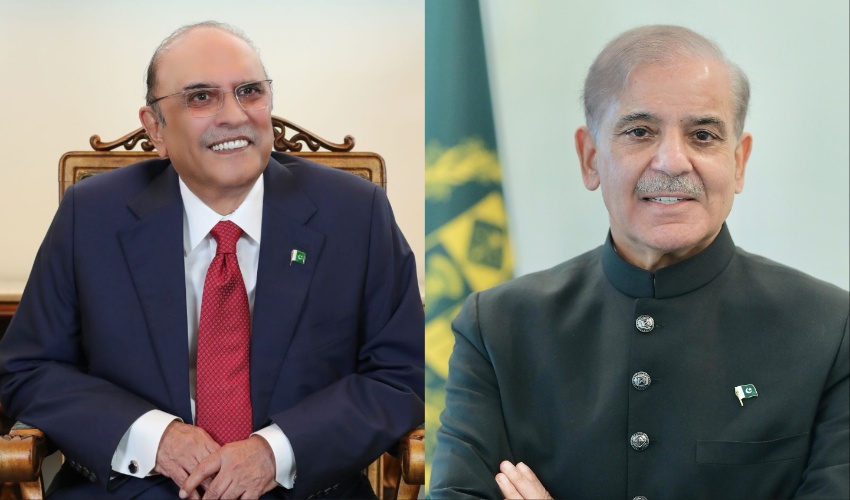

After falling below the 60,000 level during the opening hours of trading, the benchmark index settled at 61,226.93, an increase of 161.61 points or 0.26% after PMLN and other political forces hinted to settle the political uncertainty once and for all by announcing the political alliance for th new government formation.

Asian equities sank Wednesday, tracking a sell-off on Wall Street, as a forecast-topping US inflation report dealt a hefty blow to hopes for an early interest rate cut.

The dimming prospects of a dovish turn by the Federal Reserve also sent the dollar surging against the yen, forcing Japanese officials to warn they would intervene in forex markets to support the country's currency.

Expectations for a rate cut have been doused in recent weeks by a series of strong indicators -- particularly on the economy and jobs -- while several monetary policymakers warned they want to see more data before shifting.

However, stocks continued to push higher in that time, with analysts saying the Fed had indicated it is still on course to cut this year, even if not as much as previously hoped.

A small downward revision last week to inflation figures for the final few months of 2023 added to the upbeat mood.

But Tuesday's figures showing the consumer price index and core prices eased less than expected came as a severe blow, leading investors to re-evaluate their outlook for rates this year.

Eyes are now on producer price data due at the end of the week.

All three main indexes on Wall Street fell more than one percent, with the Dow and S&P 500 coming down from around record highs.

US Treasury yields jumped and the so-called "fear gauge" VIX rose at its fastest clip since October.

The "CPI report caught a lot of people off guard", Chris Zaccarelli, of Independent Advisor Alliance.

"Many investors were expecting the Fed to begin cutting rates and were spending a lot of time arguing that the Fed was taking too long to get started -- not appreciating that inflation could be sticky and not continue down in a straight line."

Saxo's Redmond Wong added: "The hot CPI report has priced out a March rate cut, now seen with only 10 percent odds."