The number of crypto owners in Pakistan stands at 14.7 million, higher than that of Russia, Indonesia, and the United Kingdom. Despite the high number of users, the regulatory environment related to cryptocurrencies in Pakistan is still uncertain.

This uncertainty is killing innovation and opportunities, such as attracting foreign direct investments and potential financial gains for the Pakistani population.

Is there a way to solve this complex regulatory hurdle? I believe what India has done in the crypto space can be studied to understand how it navigates the regulatory landscape, especially considering the significant progress made with crypto regulations.

Here’s a summary of India’s journey with crypto:

2013-2017: Circulars warning investors about the volatility of the crypto market were published. Users, holders & traders were warned about potential financial, operational, legal, customer protection and security risks to which they expose themselves when they invest in crypto. Pakistan has already been through this stage.

2018: An outright ban on investing in cryptocurrencies was proposed.

2020: SC overturned the proposal of a blanket crypto ban.

2022: Budget 2022 extended legitimacy to crypto, and conversations about regulating crypto began. This budget also introduced Virtual Digital Assets (VDA).

I believe Pakistan’s relationship with crypto will experience the same journey as India’s. However, the difference is that these conversations started happening years ago in India, and Pakistan is still lagging.

If Pakistan wants to start taxing crypto, India’s strategy can once again provide a starting point for regulating Pakistan’s crypto ecosystem.

Here’s how India proposes to tax crypto:

- A flat rate of 30% tax was introduced on VDA’s

- No deductions allowed (except costs of investments)

- Loss cannot be set off against any other income and cannot be carried forward

- Failure of deduction or payment of crypto TDS can attract a penalty under section 194S(1). It can land you in jail for 7 years.

- A general thumb rule is you will have to pay a 30% tax on profits made from the transfer of any VDA.

- For instance, if you invested INR 50,000 in $ETH at the start of FY 2022 and sold it for INR 100,000 at the end of FY 2022, you will be liable to pay 30% tax on INR 50,000

To ensure that international exchanges comply with Indian laws, FIU, India’s Financial Intelligence Unit, issued compliance show cause notices to 9 offshore virtual digital asset service providers. This is another step in the right direction for India’s crypto regulatory landscape that Pakistan can learn from.

Here’s what any VDA exchange is expected to do now:

- Register with FIU

- Appoint a Designated Director and Principal Officer

- Conduct Customer Due Diligence, including KYC

- Maintain transaction records, including reporting suspicious transactions to FIU

- Adopt an Internal Anti-Money Laundering /Know Your Customer /Counter Financial Terrorism Policy.

This acts as the perfect blueprint for countries like Pakistan, which have a high crypto user base but are confused about regulating crypto. This move by India’s FIU can accelerate crypto adoption as it clarifies the regulatory landscape being established in India. There are already functional exchanges in India that abide by the laws set by FIU. As of today, there are 31 companies registered with the FIU

This means that India’s regulatory strategy works.

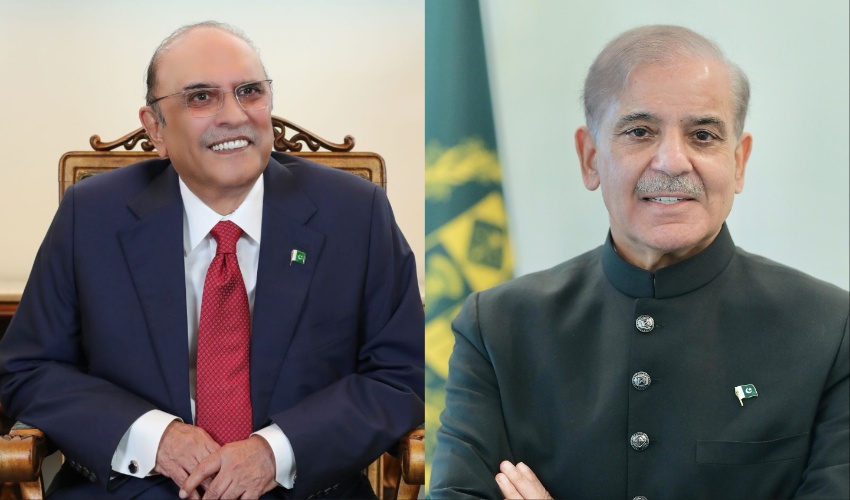

The Pakistani SECP can draw inspiration from India’s journey in crypto from outright ban to acceptance and how they made it possible. Pakistan needs to acknowledge crypto and find a way to regulate it while balancing investors and government stakeholders, as 2024 seems like a significant year for crypto.

The more we wait, the more opportunities we lose.